XRP News Today: XRP-Spot ETF Odds Surge to 95% After SEC Greenlights GDLC; BTC Dips

Key Points:

- SEC approval of Grayscale's GDLC ETF boosts XRP-spot ETF hopes; analysts raise odds of approval to 95%.

- XRP price dropped 2.93% amid SEC silence on appeal, underperforming the broader crypto market on July 1.

- Total BTC-spot ETF outflows reached $342M, potentially snapping a 16-day inflow streak as crypto tax hopes fade.

SEC Approval Ignites XRP ETF Hopes as Ripple Case Nears End

A US XRP-spot ETF market edged closer to becoming a reality on Tuesday, July 1. The SEC approved Grayscale's filing for a rule change to convert its Digital Large Cap Fund (GDLC) into the Grayscale Digital Large Cap ETF (GDLC). The ETF will provide investors exposure to BTC, ETH, ADA, SOL, and significantly, XRP.

The approval could be a prelude to the SEC approving pending XRP-spot ETF applications, which have final deadlines of October 17. Bloomberg Intelligence ETF analysts James Seyffart and Eric Balchunas recently upped the chances of the SEC approving XRP-spot ETFs by year-end to 95%.

Crypto America host and journalist Eleanor Terrett commented:

"ETF analysts James Seyffart and Eric Balchunas (who've nailed most of their predictions so far) see a 95% chance the SEC will approve spot ETFs for LTC, SOL, and XRP this year."

According to Polymarket, the odds of an XRP-spot ETF approval jumped from 77.3% on June 30 to 89% on July 1 in response to the SEC approving the GDLC ETF.

However, Blackrock (BLK) has yet to file for an XRP-spot ETF, raising questions about institutional demand for an XRP-spot ETF. BlackRock's iShares Bitcoin Trust (IBIT) has been instrumental to the success of the US BTC-spot ETF market. Since launch, IBIT has recorded total net inflows of $52.421 billion, offsetting Grayscale Bitcoin Trust's (GBTC) outflows of $23.368 billion, to deliver total BTC-spot ETF net inflows of $48.612 billion.

Despite BlackRock's absence from the XRP-spot ETF space, there has been speculation the ETF issuer could file an XRP-spot ETF application at the conclusion of the SEC vs. Ripple case.

SEC vs. Ripple Case: Appeal Vote Looms

The Ripple case is drawing to a close, a crucial step toward a US XRP-spot ETF market. Ripple announced it would drop its cross-appeal on June 27, shifting the focus to the SEC's appeal. Investors await news of the SEC withdrawing its appeal against the Programmatic Sales of XRP ruling.

An SEC vote in favor of dropping the appeal would bring an end to the Ripple case and potentially lead to BlackRock filing an XRP-spot ETF application.

Former SEC lawyer Marc Fagel commented on the next steps, stating:

"SEC likely still needs to vote to dismiss appeal. Then the parties need to submit papers dismissing their respective appeals, after which the district court's order goes into effect. Could take several weeks or more, but could possibly be expedited. No set timeframe."

The next closed SEC meeting is slated for Thursday, July 3, SEC Chair Paul Atkins and the Commissioners could vote on dropping the appeal as early as tomorrow.

XRP Price Outlook: SEC Appeal Headlines and ETF Developments

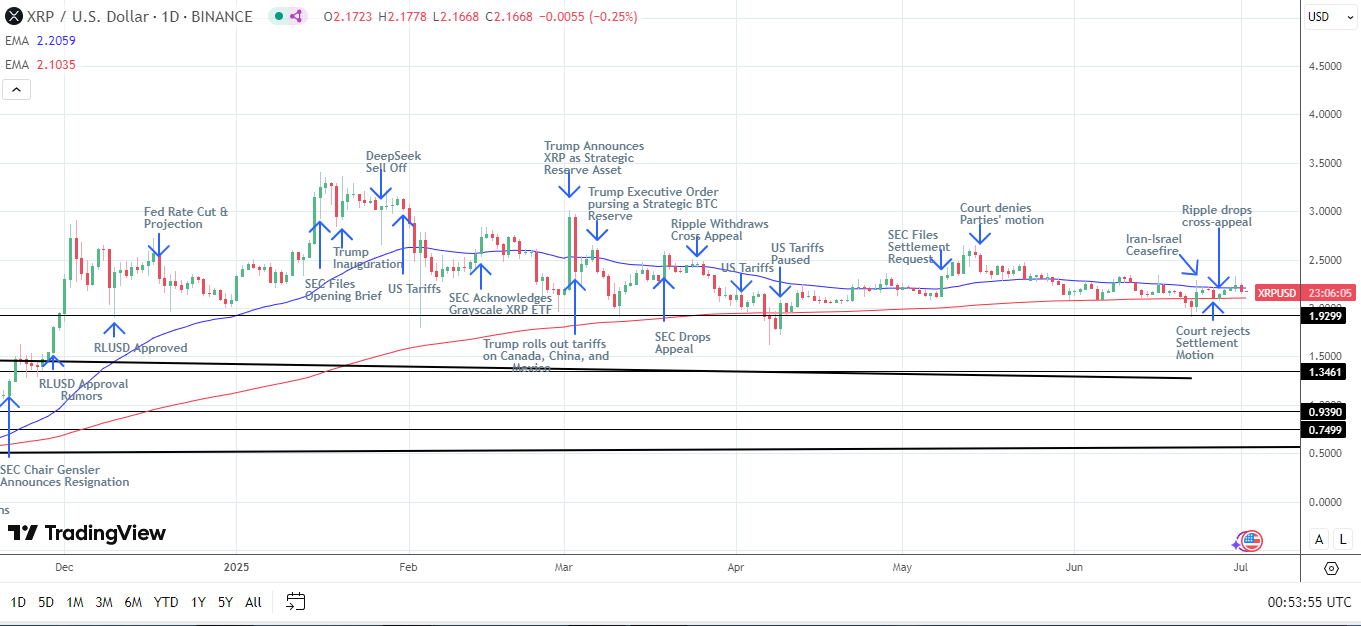

XRP slid 2.93% on Tuesday, July 1, reversing Monday's 1.41% gain to close at $2.1723. The token underperformed the broader market, which fell 1.8% to a total crypto market cap of $3.21 trillion. The SEC's silence on its appeal strategy left the token with heavier losses.

The near-term XRP price trajectory hinges on the SEC's appeal strategy and XRP-spot ETF-related developments.

A breakout above the 50-day Exponential Moving Average (EMA) could pave the way to a June 16 high of $2.3389. A sustained move through $2.3389 could enable the bulls to target the May high of $2.6553.

Conversely, a drop below the 200-day EMA could expose sub-$2 levels and the $1.9299 support level.

XRPUSD – Daily Chart – 020725

Bitcoin Drops to $105k on Crypto Tax Disappointment

While XRP dropped amid legal uncertainties, bitcoin (BTC) extended its losses from June 30 as investors reacted to the One Big Beautiful Bill Act (OBBB) vote on July 1. Hopes of amendments to crypto taxation, including capital gains ended, with lawmakers passing the bill without crypto tax exemptions.

Senator Cynthia Lummis had previously indicated she would address current taxation on crypto miners and stakers, stating:

"For years, miners and stakers have been taxed TWICE. Once when they receive block rewards, and again when they sell it. It's time to stop this unfair tax treatment and ensure America is the world's Bitcoin and Crypto Superpower."

US BTC-Spot ETF Market Snaps Sixteen-Day Inflow Streak

The absence of crypto tax amendments and Fed Chair Powell's wait-and-see stance on monetary policy impacted US BTC-spot ETF flow trends. On July 1, Fed Chair Powell remained non-committal on the timing of a Fed rate cut, reportedly stating:

"Not going to rule in or rule out any particular meeting. Officials will be monitoring, particularly, what does show up in terms of inflation or what does not show up."

The Fed Chair remained concerned that tariffs could push inflation higher.

According to Farside Investors, Key flow trends for July 1 included:

Fidelity Wise Origin Bitcoin Fund (FBTC) had net outflows of $172.7 million.

Grayscale Bitcoin Trust (GBTC) reported net outflows of $119.5 million.

ARK 21Shares Bitcoin ETF (ARKB) saw net outflows of $27 million.

Bitwise Bitcoin ETF (BITB) had net outflows of $23 million.

With BlackRock's iShares Bitcoin Trust (IBIT) flow data pending, total US BTC-spot ETF outflows reached $342.2 million, potentially ending a sixteen-day inflow streak.

BTC Price Outlook: Trade developments, US Data, the Fed, and ETF Flows

BTC fell 1.33% on July 1, following Monday's 1.09% loss, closing at $105,743.

The near-term price outlook depends on several key drivers, including US economic data, Fed monetary policy guidance, legislative developments, trade headlines, and ETF flows.

Potential scenarios:

Bearish Scenario: Easing global trade tensions, legislation roadblocks, hawkish Fed signals, weak US data, and ETF outflows. A combination of these may drag BTC toward the 50-day Exponential Moving Average (EMA), potentially exposing $100,000.

Bullish Scenario: Renewed trade tensions, bipartisan support for crypto bills, dovish Fed rhetoric, strong US data, and ETF inflows. Under these scenarios, BTC could retarget its all-time high of $111,917.

BTCUSD – Daily Chart – 020725