Tariffs Weigh On Sentiment Of Big 4 Private Equity Firms

Summary

- Tariff-related uncertainty appeared to weigh on the outlook of the Big Four private equity firms as they reported first-quarter earnings.

- All of the Big Four firms added to their total AUM in the first quarter, led by Blackstone, which reported quarterly inflows of $61.6 billion.

- The total return performance of the Big Four firms was negative between the start of the year and the end of first-quarter earnings season, with all four firms experiencing stock price declines between Jan. 1 and mid-May.

Tariff-related uncertainty appeared to weigh on the outlook of the Big Four private equity firms as they reported first-quarter earnings.

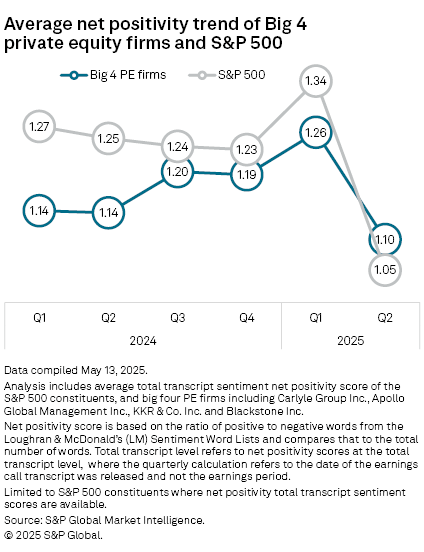

The average net positivity score for the Big Four private equity firms dipped to its lowest level in more than a year, although the decline was less pronounced than the steeper quarter-over-quarter drop in sentiment across the S&P 500, according to an S&P Global Market Intelligence analysis of the language used by executives and analysts on the calls.

The Big Four — Apollo Global Management Inc. (APO), Blackstone Inc. (BX), The Carlyle Group Inc. (CG) and KKR & Co. Inc. (KKR) — are the largest publicly traded alternative asset managers by assets under management.

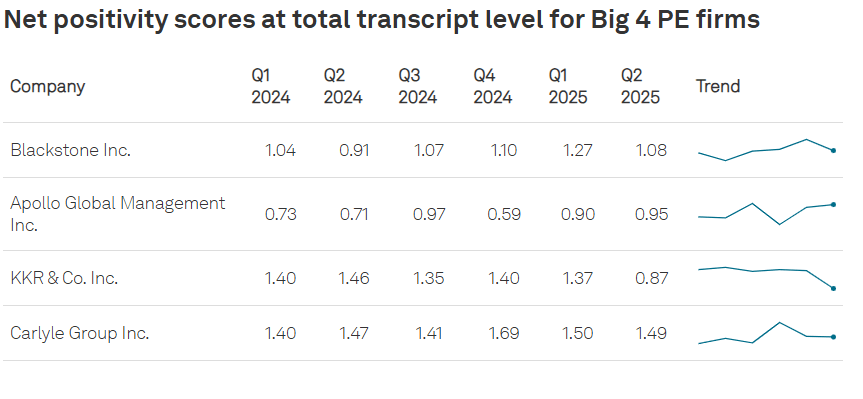

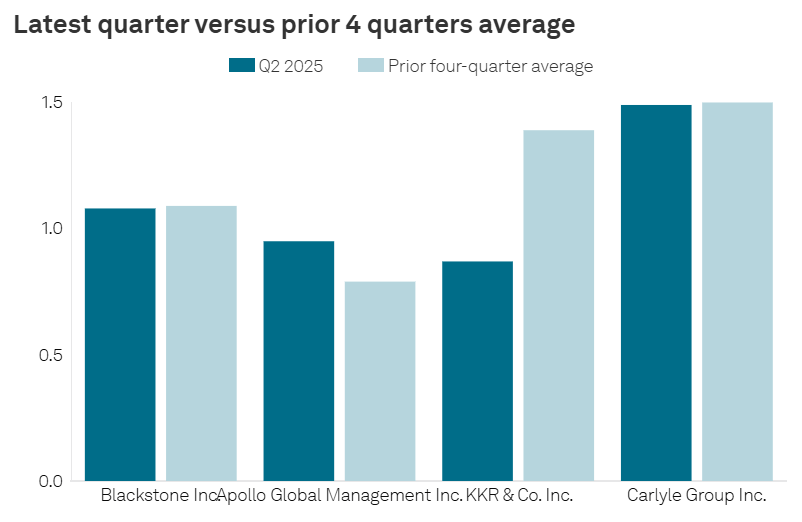

Among peer firms, KKR recorded the most significant drop in its first-quarter sentiment score compared to the prior four-quarter average.

That was despite CFO Robert Lewin reassuring shareholders that 90% of the firm's private equity portfolio was insulated from the immediate repercussions of tariffs and that KKR was taking steps to mitigate tariff impacts on the remainder of the portfolio. Management was also evaluating the potential of tariffs to slow global growth, lead to inflation and delay interest rate cuts, Lewin said.

"We're trying to anticipate what could happen next and be in a position where we can really react to things either proactively or very quickly if things change from our base case," Lewin said.

KKR Co-CEO Scott Nuttall said the firm aimed to "keep investing when others are scared," leaning into the macroeconomic uncertainty.

"In our experience, times like this yield some very attractive investment opportunities," Nuttall said.

"All of this created a big economic boom," Vukovic said.

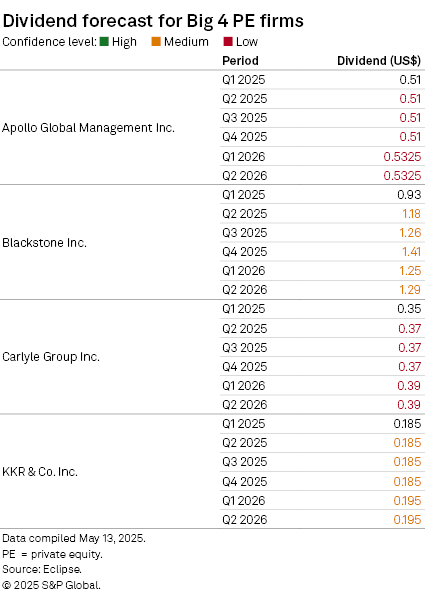

Data compiled May 13, 2025. E = private equity.

Analysis includes average total transcript sentiment net positivity scores of select PE firms including Carlyle Group Inc., Apollo Global Management Inc., KKR & Co. Inc. and Blackstone Inc.

Net positivity score is based on the ratio of positive to negative words from the Loughran & McDonald’s (LM) Sentiment Word Lists and compares that to the total number of words. Total transcript level refers to net positivity scores at the total transcript level, where the quarterly calculation refers to the date of the earnings call transcript was released and not the earnings period.

Source: S&P Global Market Intelligence.

Exit impact

The uncertain outlook complicates the exit picture, Blackstone CEO Stephen Schwarzman acknowledged on the firm's first-quarter earnings call. Globally, the value and volume of private equity exits sank to a two-year low in the first quarter.

"More volatile markets do mean we are less likely to sell in the near term, although that can change if conditions improve," Schwarzman said.

A reduction in exits broadly would slow the return of capital to the private equity firms' limited partners, adding to the strain on the private equity investment cycle. Lower levels of distributions in recent years have created liquidity issues for limited partners, restricting their ability to make new fund commitments and contributing to a three-year decline in private equity fundraising.

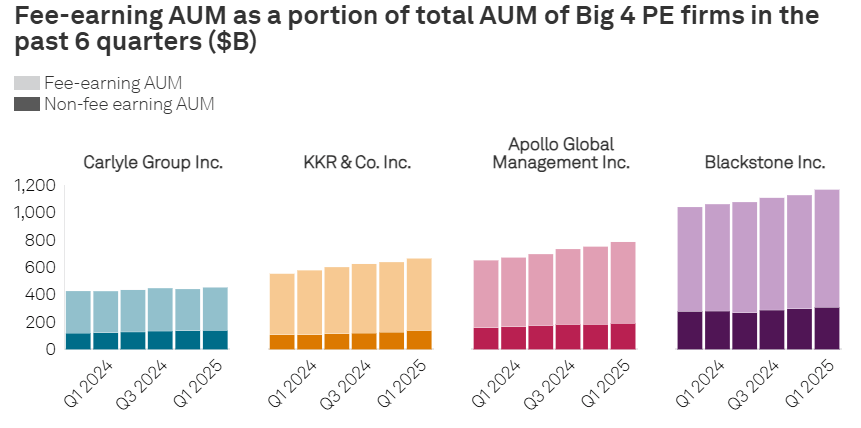

AUM growth

All of the Big Four firms added to their total assets under management (AUM) in the first quarter, led by Blackstone, which reported quarterly inflows of $61.6 billion. Already the largest of the four, Blackstone grew its AUM to nearly $1.17 trillion in the first quarter, up 4.6% from $1.13 trillion in the fourth quarter 2024.

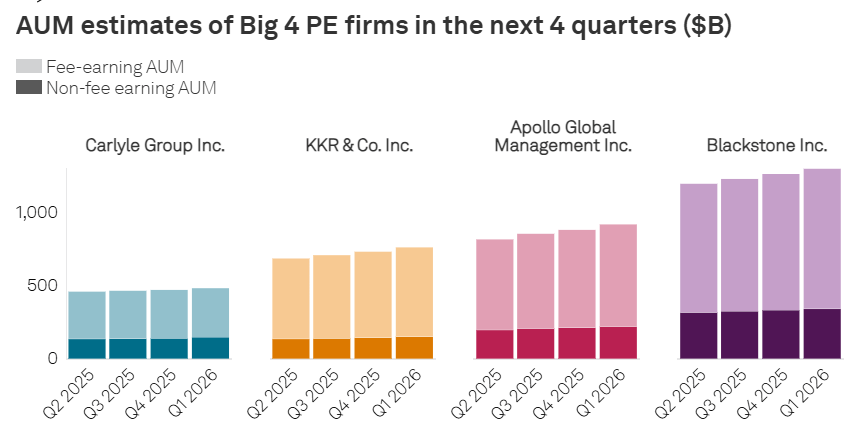

Data compiled May 13, 2025. AUM = assets under management; PE = private equity.

Fee-earning AUM is the company's assets that are under management on which the company is earning fees. Non-fee earning AUM is calculated as the difference between total AUM and fee-earning AUM.

Analysis includes assets under management and fee-earning assets under management of Carlyle Group Inc., Apollo Global Management Inc., KKR & Co. Inc. and Blackstone Inc.

Source: S&P Global Market Intelligence.

KKR led on year-over-year growth, expanding AUM 15% to $664.32 billion as of the end of the first quarter. But Apollo was projected to grow fastest over the next year, increasing its AUM 16.7% to nearly $1.3 trillion by the first quarter of 2026, according to consensus forecast data from Visible Alpha, a part of Market Intelligence.

Carlyle, by contrast, was expected to lag its peer firms, expanding AUM 6.2% to $480.8 billion by the first quarter of 2026, according to Visible Alpha.

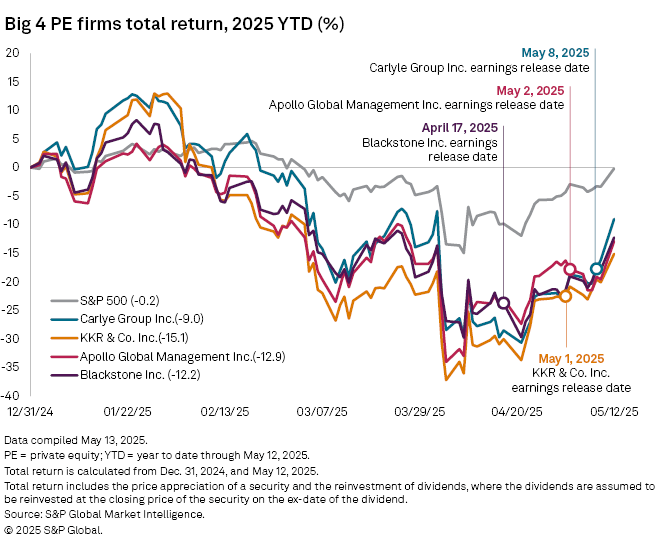

Total return performance

The total return performance of the Big Four firms was negative between the start of the year and the end of first-quarter earnings season, with all four firms experiencing stock price declines between Jan. 1 and mid-May. The most significant drops coincided with President Donald Trump's April 2 tariff announcement.

All four also lagged the total return performance of the S&P 500 over Jan. 1–May 12.

Blackstone paid out the largest dividend in the first quarter. The firm's 93-cent dividend is projected to rise to $1.25 by the first quarter of 2026, according to Eclipse, an S&P Global dividend forecasting service.